This guide shows how to design a TCFD-aligned climate-risk report – or a dedicated section within your Sustainability or ESG report – that meets SB 261 expectations. We outline what to include under the four TCFD pillars and how professional design improves clarity, credibility, and stakeholder trust.

What is the TCFD framework?

The Task Force on Climate-related Financial Disclosures (TCFD) was created by the Financial Stability Board to help organisations disclose clear, consistent, and comparable information on the financial impacts of climate change.

The framework is internationally recognised and, in the U.S., is referenced by California’s Senate Bill 261, which requires large companies to report climate-related financial risks in line with TCFD recommendations.

TCFD is built around four pillars – Governance, Strategy, Risk Management, and Metrics and Targets – which guide how to identify, assess, and communicate climate-related risks and opportunities. For detailed guidance, see the TCFD recommendations and the California SB 261 legislation.

What Does TCFD Alignment Mean?

TCFD-aligned report helps organisations disclose climate-related financial risks and opportunities in a consistent and transparent way. In California, Senate Bill 261 (SB 261) requires large companies to publish these reports biannually, beginning in 2026. Each report must address four core disclosure areas:

- Governance – how climate-related risks and opportunities are managed at the leadership level

- Strategy – how climate issues impact the organisation’s business and financial planning

- Risk Management – processes for identifying, assessing, and managing climate-related risks

- Metrics and Targets – data and goals used to measure climate risk and performance

You can publish this as a stand-alone report or as a dedicated section within your ESG or sustainability report.

Other reporting frameworks and tools

While this guide focuses on the TCFD framework – now mandatory under California’s SB 261 – many organisations also reference or align with other sustainability and ESG reporting standards depending on their region. If you’re looking for a technology solution to help build your report based on a specific framework, companies such as Diginex provide products and solutions that help companies manage disclosures across multiple frameworks, including TCFD, GRI, SASB, and ISSB. Understanding how these frameworks intersect can help your organisation maintain consistency in its broader sustainability reporting strategy.

Why Good Report Design Matters for TCFD Disclosures

Effective sustainability report design isn’t just about making things look nice. Good layout and formatting help:

- Communicate climate risk data clearly and professionally

- Strengthen stakeholder engagement and trust by showing that your organisation takes branding, presentation and disclosure seriously

- Align with ESG best practice and accessibility standards (WCAG)

- Signal transparency and accountability to investors and regulators

- Improve comparability year on year across the four TCFD pillars

A thoughtfully designed report supports decision-making and enhances your organisation’s reputation in the sustainability space.

Designing TCFD-Aligned Content in Your Sustainability Report

Here are our top recommendations for designing a strong, user-friendly TCFD-aligned climate-risk section in your sustainability or ESG report:

- Establish visual hierarchy using consistent headings, colour coding, and clear section dividers

- Use icons and infographics to visualise climate risks, emissions scopes, and timelines

- Include charts and diagrams to support your scenario planning and governance structure

- Ensure accessibility with readable fonts, appropriate colour contrast, and structured content layout – refer to the W3C Web Accessibility Guidelines for compliance best practices

- Optimise for digital and print with a responsive layout that works across formats

- Make your charts large, clear, and professionally styled to help readers understand Scope 1, 2 and 3 emissions data and associated targets.

Understanding Scope 1, 2, and 3 Emissions

Emissions reporting is a key part of the Metrics and Targets section of your sustainability or ESG report. Under frameworks like SB 261, organisations are expected to disclose their Scope 1, 2, and 3 greenhouse gas (GHG) emissions:

- Scope 1: Direct emissions from owned or controlled sources (e.g. company vehicles or facilities

- Scope 2: Indirect emissions from purchased electricity, steam, heating or cooling

- Scope 3: All other indirect emissions in your value chain, including purchased goods, transportation, employee commuting and more

Scope 3 is often the most challenging to measure, but also one of the most scrutinised by stakeholders and regulators.

Well-designed and thoughtfully structured sustainability reports can help clarify boundaries, explain methodology and visualise year-on-year progress or intensity metrics.

Templates to Streamline Your TCFD Reporting

We offer editable templates to help your team build TCFD-aligned disclosures faster:

- Custom PowerPoint or Word templates structured to the four TCFD pillars

- Branding and layout guidance for internal teams

- Pre-styled charts for Scope 1, 2, and 3 with notes fields for boundaries and methods

- Optional icon set and data-visualisations styles for risk, governance and scenario planning

Need a tailored pack?

Get in touch and we’ll scope the right template for your sustainability or ESG report.

Real Examples of TCFD-Aligned Sustainability Report Design

Looking for sustainability report consultation? We recommend reviewing reports from:

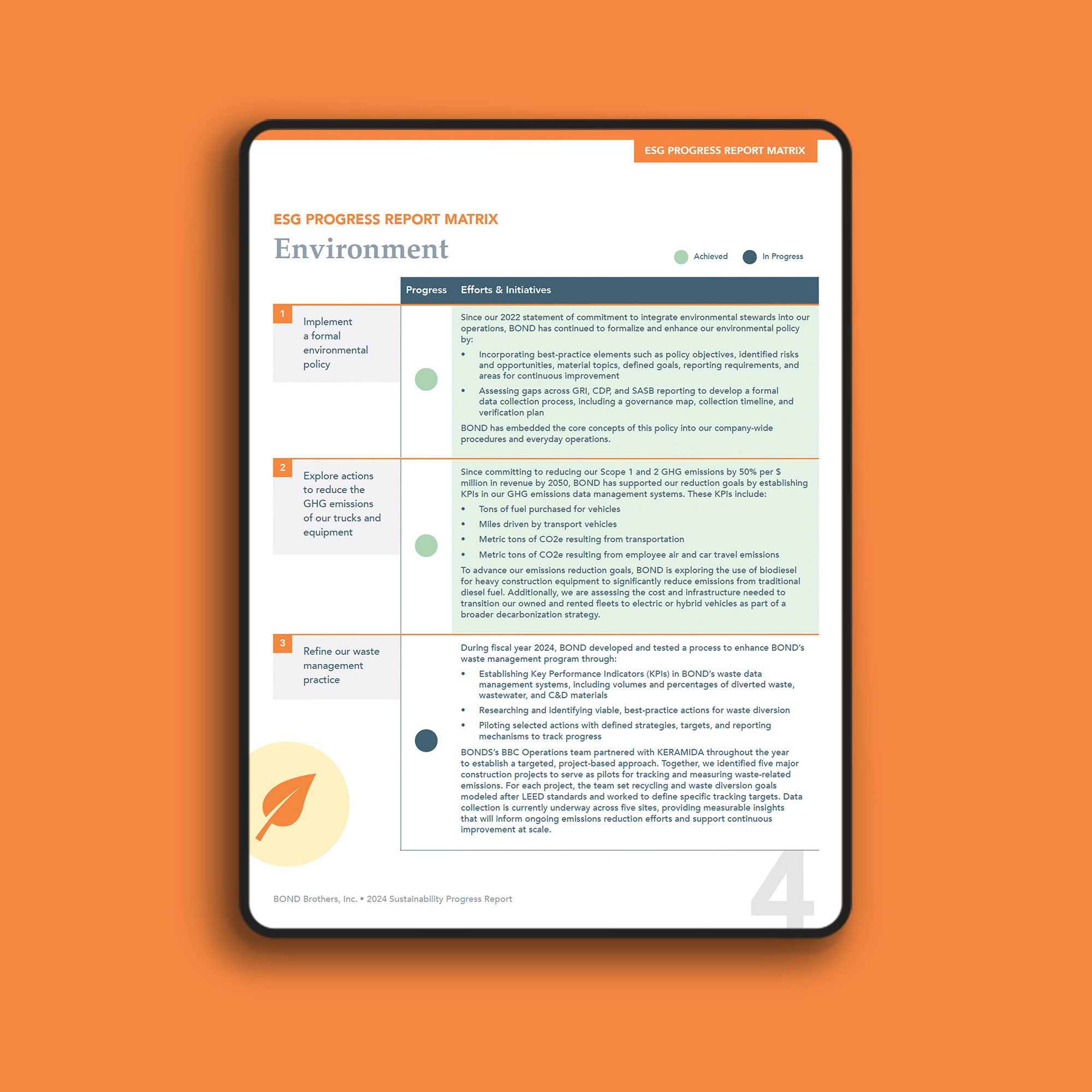

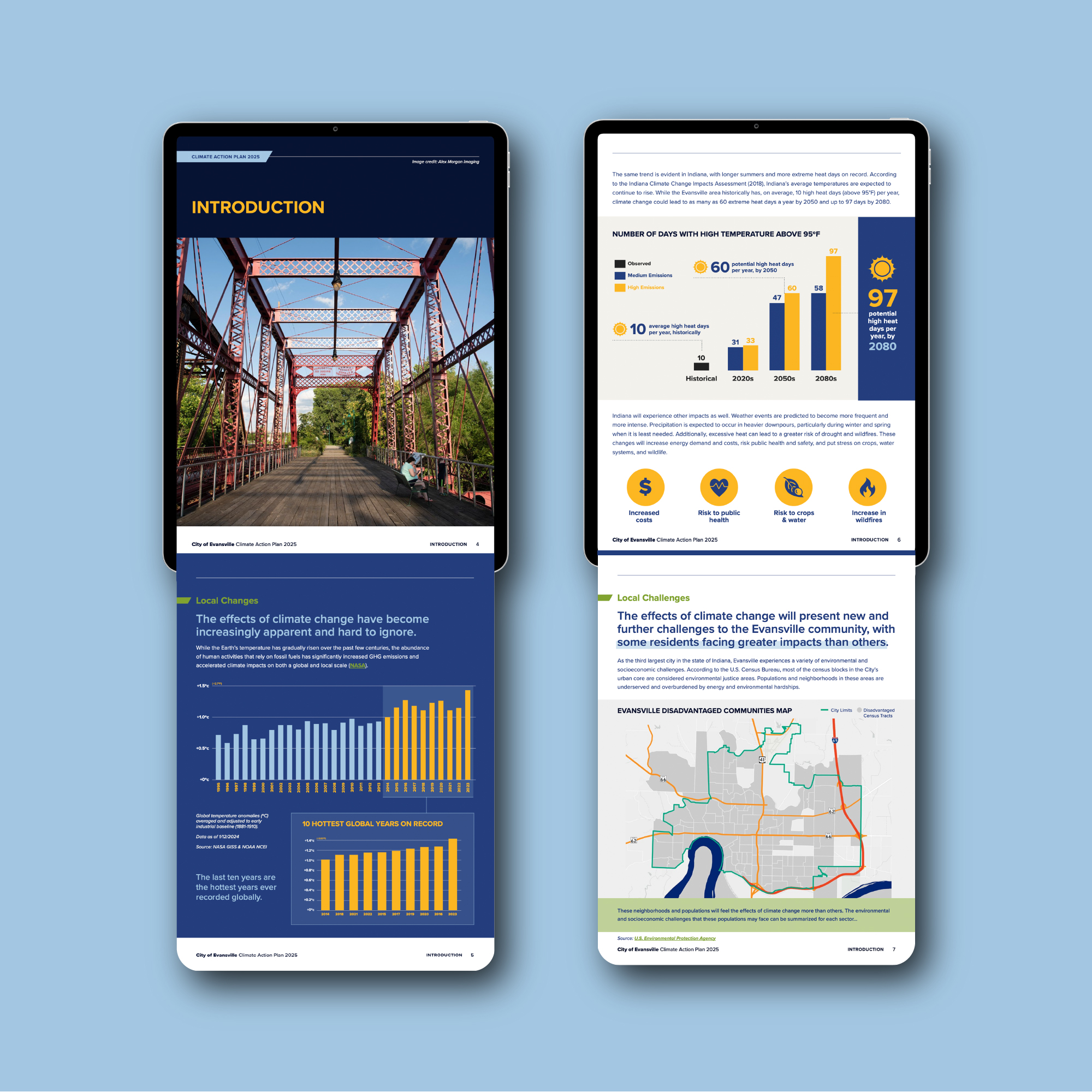

KERAMIDA Inc.

We work with global sustainability and EHS consultancy KERAMIDA to design a wide range of TCFD-aligned reports for their clients – from Climate Action Plans and GHG Inventories to Double Materiality Assessments. Their expertise in climate risk analysis, emissions data and ESG strategy pairs perfectly with our design support.

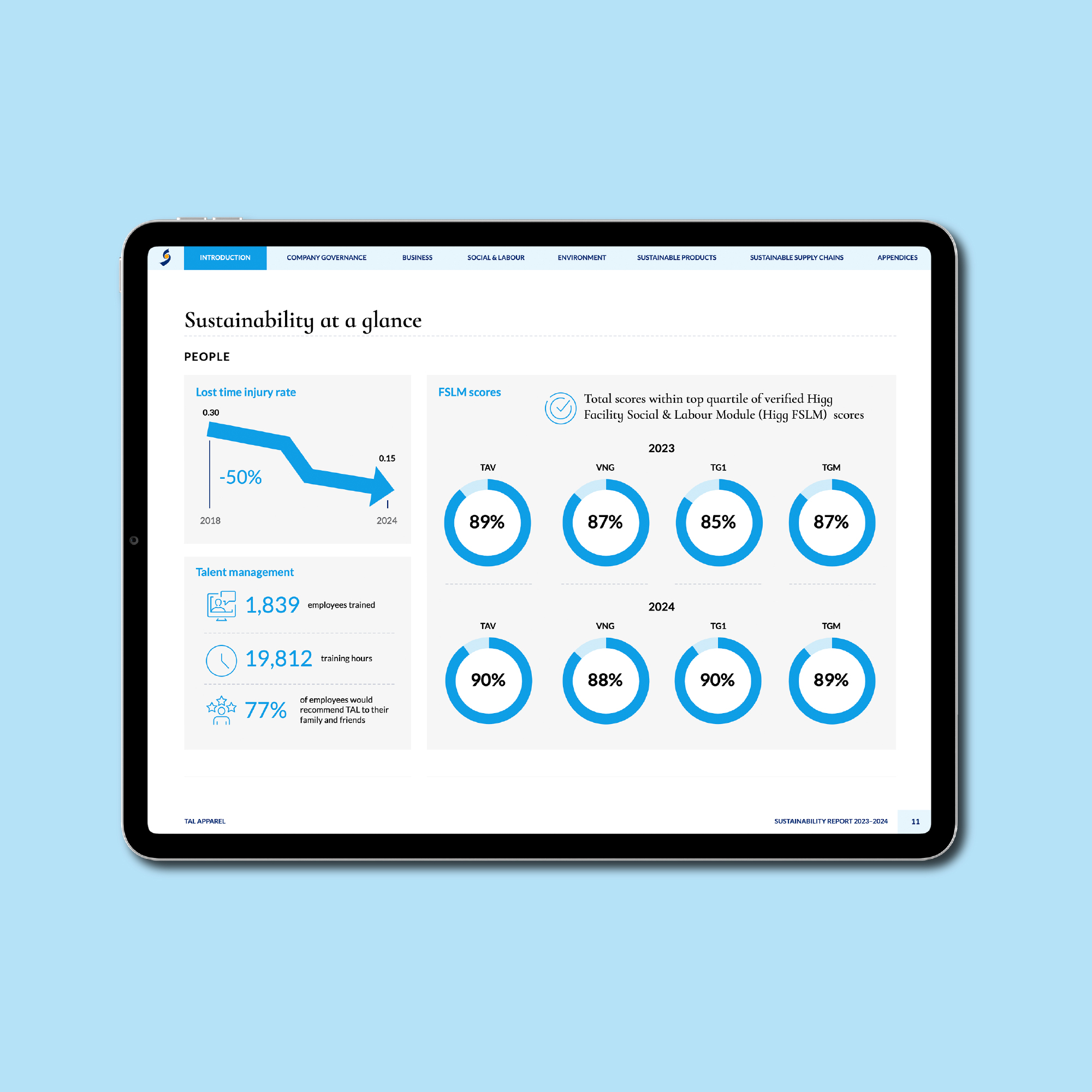

We’ve also supported climate-related and sustainability reporting across multiple sectors, with reports informed by evolving global standards such as those introduced in the EU, UK, and US. See, for example, our TAL Apparel case study.

How Much Does an ESG or Sustainability Report Cost to Design?

Designing a full ESG or sustainability report typically ranges from USD $4,000–$15,000, depending on:

- Report length and data complexity

- Design requirements (print, digital, or both)

- Custom graphics, infographics, and icon development

Need help designing your TCFD-aligned report?

Visit our sustainability report design service page or request a quote below – we’ll scope the right approach for your goals:

Request a quote